Puzzle — Smarter Accounting Software Designed for Startups

Introduction

Effective financial management is essential to a startup's survival and expansion; it's not just a compliance issue. Conventional accounting software frequently gives the impression that it was designed for large finance teams in established corporations rather than the resource-constrained, fast-paced world of early-stage startups. By providing accounting software that combines automation, real-time insights, and startup-specific design, Puzzle alters this dynamic and makes financial management more intelligent, quick, and user-friendly. Puzzle gives founders a platform that gives them clarity and control right away, eliminating the need for them to choose between costly accountants or cumbersome spreadsheets. Puzzle enables startup teams to stay ahead of the curve and make well-informed decisions by streamlining intricate financial tasks and converting data into useful insights.

How it Works

Puzzle automatically gathers financial data and classifies transactions in real time by connecting to your bank accounts, payment processors, and business tools. From managing SaaS subscriptions and contractor payments to tracking investor funding and runway, the software is made to comprehend the particular workflows of startups. While its dynamic dashboards give founders easily comprehensible summaries of cash flow, expenses, and revenue trends, its intelligent automation reduces the amount of manual entry. In order to facilitate smooth communication between founders, finance teams, and outside accountants, Puzzle also integrates with well-known productivity tools. It guarantees that compliance and reporting are always a step ahead, not an afterthought, by offering audit-ready books and instantly reconciling transactions.

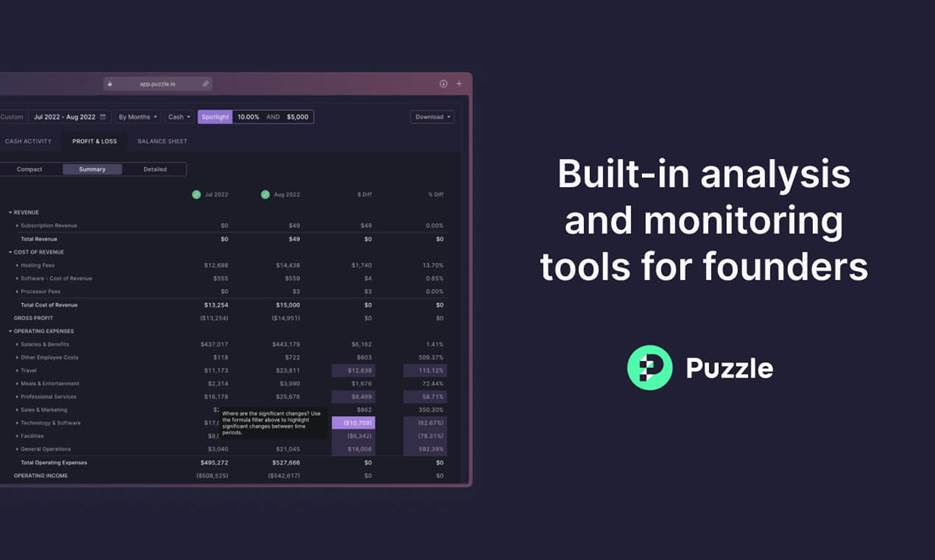

A Glance at Puzzle.io Interface :-

Why it Matters

Financial clarity in the early phases of a company's development can mean the difference between it scaling successfully and going out of business. For the simple reason that traditional tools are too complicated or time-consuming for non-accountants to use efficiently, many startups function with little financial oversight. Poor strategic choices, lost tax opportunities, and excessive spending can result from this lack of transparency. By making accounting as simple as using a contemporary project management tool, Puzzle solves these problems. Founders can now understand their company's financial health without waiting until the end of the month or, worse, the end of the quarter thanks to real-time data. Rapid decision-making supported by precise and up-to-date data guarantees that strategy is in line with reality.

Why It’s Important for Startups

Startups work in a setting where every dollar matters and every choice is taken very seriously. Conventional accounting methods frequently necessitate employing a bookkeeper or devoting valuable founder time to financial upkeep, both of which can impede progress. By automating repetitive tasks, identifying irregularities before they become costly mistakes, and offering actionable insights into spending and growth patterns, Puzzle assists startups in operating lean. With transparent records, comprehensive reports, and easily shareable visual dashboards for board meetings and fundraising pitches, Puzzle provides founders overseeing investor funds with transparency that fosters trust. Startups using Puzzle can increase their runway, easily maintain compliance, and concentrate on what they do best—developing and growing their business—by integrating smart accounting into the foundation of their operations.

Benefits

Automated Data Entry and Categorization – Puzzle pulls transactions directly from connected accounts, intelligently categorizes them, and updates records in real time, saving hours of manual bookkeeping every month.

Real-Time Financial Insights – Interactive dashboards present up-to-the-minute cash flow, expense, and revenue data, allowing founders to make confident, timely decisions.

Runway and Burn Rate Tracking – Built-in startup-focused metrics help monitor operational runway, monthly burn, and funding utilization, enabling proactive financial planning.

Seamless Collaboration – Invite team members, accountants, or investors to view specific reports and dashboards without exposing unnecessary data.

Integrated Compliance and Reporting – Automatically prepares audit-ready financial statements and keeps all tax-related records organized for hassle-free filing.

.

Final Thought

Puzzle is a strategic financial partner for startups and offers more than just accounting software. It guarantees that financial management is no longer a bottleneck but rather a catalyst for more intelligent choices and quicker growth by combining automation, real-time visibility, and startup-specific intelligence. Puzzle gives founders the clarity they need to satisfy investors, manage cash flow, and negotiate the uncertain early-stage business landscape without compromising their time or concentration. Puzzle offers the resources needed to advance with assurance and sustainability in a startup environment where accuracy and agility are crucial.

Disclaimer

As of the publication date, the information shared here is based on publicly available resources. For the most accurate and updated details, please visit

https://puzzle.io/

.