Ramp — Enterprise Corporate Cards Built to Save Your Company Money

Introduction

For both startups and large corporations, financial management is a crucial component. Conventional business cards tend to emphasize spending power rather than spending intelligence. By providing corporate cards and an expense management platform that enables companies to do more than just spend, Ramp changes this dynamic. Ramp guarantees that every dollar spent is a dollar optimized for growth through integrated automation, real-time insights, and policy controls.

How it Works

Ramp provides both virtual and physical business cards linked to a platform that offers detailed spending analytics, integrates with accounting software, and automates expense tracking. AI-driven insights spot redundant or superfluous subscriptions, enforce company-wide policies, and find areas for cost savings. Teams can provide employees with flexibility without compromising control by issuing unlimited cards with personalized limits. In order to guarantee that companies are receiving the best value from their vendors, the platform also bargains for discounts on frequently used services.

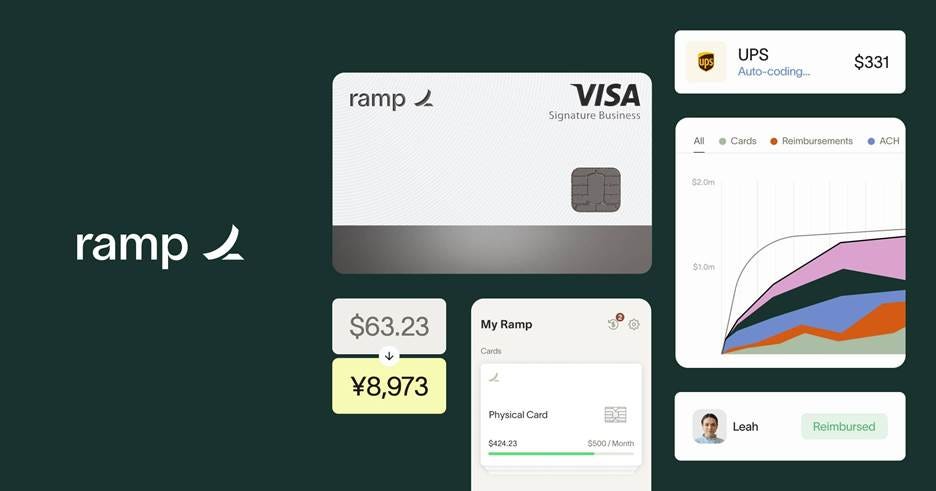

A Glance of Ramp :-

Why it Matters

Startups can grow rapidly, but if spending is not controlled, it frequently gets out of hand. Conventional business cards don't offer a way to reduce waste, which leads to financial inefficiencies that hinder expansion. By integrating savings into the financial infrastructure, Ramp, on the other hand, enables leaders to make more informed choices without increasing manual oversight or recruiting more finance personnel.

Why It’s Important for Startups

The runway is crucial for startups. By lowering burn and real-time spend optimization, Ramp expands on it. Ramp ensures that the company's financial health scales with its ambitions while allowing founders to concentrate on creating products. This includes automating compliance reports, catching unused SaaS licenses, and consolidating vendor agreements.

Benefits

Automated Savings – Ramp identifies unnecessary spending and negotiates discounts, ensuring businesses save without extra effort.

Real-Time Visibility – Access detailed analytics on how, when, and where money is being spent—empowering smarter budgeting decisions.

Streamlined Expense Management – Automate reimbursements and integrations with accounting software, eliminating manual processes.

Scalable Controls – Issue unlimited cards with adjustable limits, allowing teams to operate independently while staying compliant.

Final Thought

Ramp is a more intelligent approach to controlling and maximizing spending than a simple business card. Businesses can find savings, maintain real-time visibility, and automate financial controls with minimal effort by integrating intelligence into every transaction. Larger teams benefit from a scalable system that boosts productivity as they expand, while startups benefit from a longer runway and leaner operations. Ramp helps businesses grow more quickly, run more efficiently, and scale sustainably by transforming corporate spending into a strategic advantage.

Disclaimer

As of the publication date, the data presented here is based on publicly accessible information. For the most precise and comprehensive details, go to ramp.com .