Upflow — Automating Receivables for Financial Efficiency

For many startups, even with a brilliant product and promising market traction, cash flow challenges can become a silent killer. Payments delayed by just a few weeks can ripple through operations, putting pressure on everything from salaries to marketing budgets.

This is where Upflow plays a pivotal role. It’s a modern accounts receivable automation platform designed to help startups gain control over unpaid invoices, streamline communication with clients, and ultimately create more predictable cash flow—without the need for a dedicated finance team.

How it works:

Upflow functions as an intelligent bridge between your startup and your accounting software, such as QuickBooks, Xero, or NetSuite. Once integrated, it automatically tracks every invoice sent, flags overdue payments, and initiates structured, polite follow-up reminders to clients.

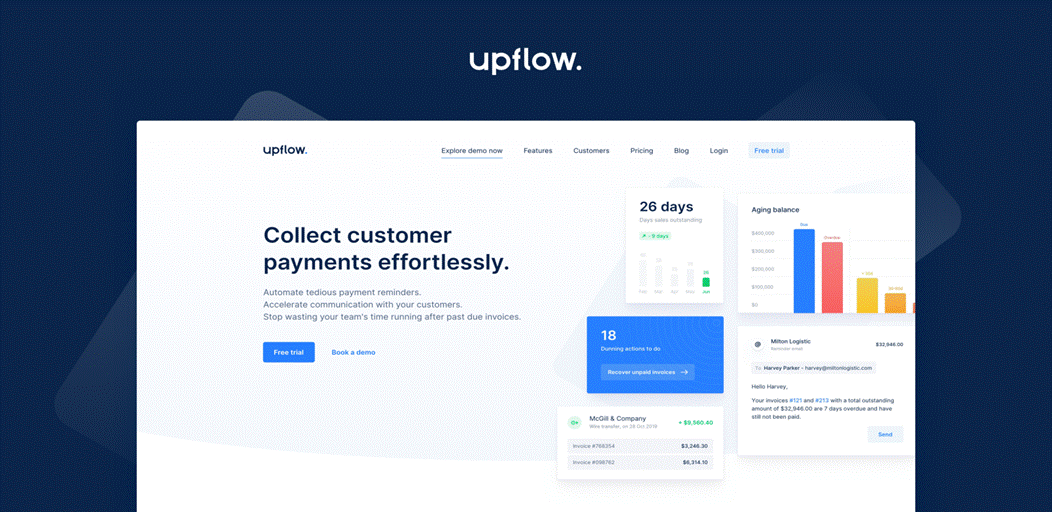

Instead of relying on manual spreadsheets, you get a centralized dashboard where you can see all receivables in one place—organized by client, payment status, and due dates. You can also customize communication flows, assign priorities, and monitor aging reports in real-time. Whether you're handling 5 clients or 50, Upflow ensures nothing slips through the cracks.

Sneak Peak

Here’s a glance at Upflow Interface :

Why it matters:

Startups often operate on thin margins and limited capital reserves. A single delayed invoice can halt planned hiring, delay a product launch, or prevent a critical software renewal. Moreover, the manual task of following up on payments often falls to the founder or a stretched operations manager—adding stress and wasting valuable hours.

Upflow eliminates the emotional burden of asking for money and replaces it with structured, automated, and respectful communication. By ensuring invoices don’t go ignored, it preserves business relationships while protecting your bottom line.

Why It’s Important for Startups

Unlike large enterprises, startups typically don’t have full-fledged finance departments or dedicated collections teams. Financial discipline, however, is no less important at this stage. In fact, it's more crucial.

Upflow helps bring that discipline without hiring additional staff. It empowers small teams to operate with the same financial hygiene and professionalism as a large company. The clarity and consistency it brings to cash flow management are especially vital during fundraising, audits, or investor reporting—where transparency around revenue and receivables matters greatly.

Benefits

Timely Payments Through Automated Reminders - Upflow sends structured, polite payment reminders to clients on your behalf, ensuring that invoices are paid without uncomfortable conversations.

Improved Cash Flow Visibility - The platform gives you a bird’s-eye view of outstanding amounts, due dates, and trends—so you can forecast revenue accurately and plan better.

Reduced Manual Workload- Instead of spending hours each week chasing payments, your team can focus on product development and customer service.

Increased Professionalism - Automated follow-ups and clean reporting enhance your brand’s credibility and signal maturity to clients and investors

Final Thought

In the early stages of building a company, it’s easy to prioritize product, marketing, and growth—and overlook the importance of strong financial operations. But the reality is that even with great traction, poor receivables management can stall your momentum.

Upflow is more than just a payment reminder tool. It’s a financial co-pilot that brings automation, structure, and peace of mind to one of the most important (yet overlooked) parts of running a business. For any startup aiming to scale responsibly and sustainably, Upflow is not just helpful—it’s essential.

Disclaimer

The information provided here is based on publicly available data as of the date of publication. We strive to ensure accuracy and reliability, but we recommend visiting the official upflow.io for the most up-to-date and detailed information.

If you have any questions, concerns, or feedback regarding the content shared here, please feel free to reach out to us directly at hello@startupvisors.com. We value your input and are here to assist you.